The Debt Management Office (DMO) has said that Nigeria has been able to raise $4 billion through Eurobonds.

According to the DMO, this latest development can be described as “one of the biggest financial trade to come out of Africa in 2021.”

The DMO revealed that against the $3 billion that was initially announced by the federal government, the Order Book peaked at $12.2 billion, which enabled the country raise $1 billion more.

Speaking on this, the Debt Management Office said in a press release:

“This exceptional performance has been described as one of the biggest trades to come out of Africa in 2021 and an excellent outcome.

“Bids for the eurobonds were received from investors in Europe and America as well as Asia.

“There was also good participation by local investors. The size of the Order Book and the quality of investors demonstrates confidence in Nigeria.”

According to a report by Voice of Nigeria, “the Eurobonds were issued in three tranches: 7 years ($1.25 billion at 6.125% per annum); 12 years ($1.5 billion at 7.375% per annum); and 30 years ($1.25 billion at 8.25% per annum).”

This is said to be well aligned with Nigeria’s Debt Management Strategy, 2020 – 2023.

Source: Voice Of Nigeria

Kagame Condemns International “Threats” Directed At Rwanda As US Sanction Looms

Kagame Condemns International “Threats” Directed At Rwanda As US Sanction Looms  Bandits Kill Nearly 200 In Kwara And Katsina State

Bandits Kill Nearly 200 In Kwara And Katsina State ![Saif al-Islam Gaddafi after being captured in Zintan, Libya, on November 19, 2011 [Ammar El-Darwish/AP Photo]](https://www.lionscrib.com/wp-content/uploads/2026/02/image-4-720x513.webp) Muammar Gaddafi’s Son Seif al-Islam Gaddafi Killed

Muammar Gaddafi’s Son Seif al-Islam Gaddafi Killed  US Set To Deport 79 Nigerians

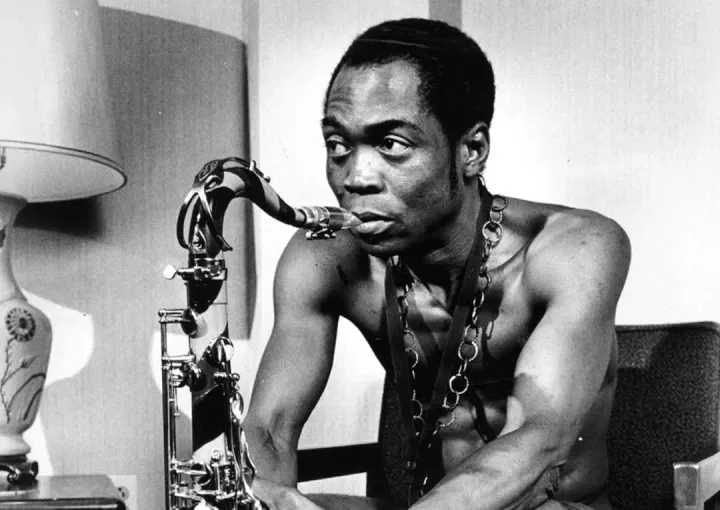

US Set To Deport 79 Nigerians  Fela Kuti Becomes First African Artist To Receive Posthumous Grammy Lifetime Achievement Award

Fela Kuti Becomes First African Artist To Receive Posthumous Grammy Lifetime Achievement Award  Venezuela Rejects US Interference, Says Interim Leader Rodríguez

Venezuela Rejects US Interference, Says Interim Leader Rodríguez  Actor Omotola Jalade Ekeinde Says She Won’t Dance To Promote A Movie

Actor Omotola Jalade Ekeinde Says She Won’t Dance To Promote A Movie